“Microfinance in the New Reality: Weathering the Storm”

“Microfinance in the New Reality: Weathering the Storm”

by: AMA

November 26, 2020

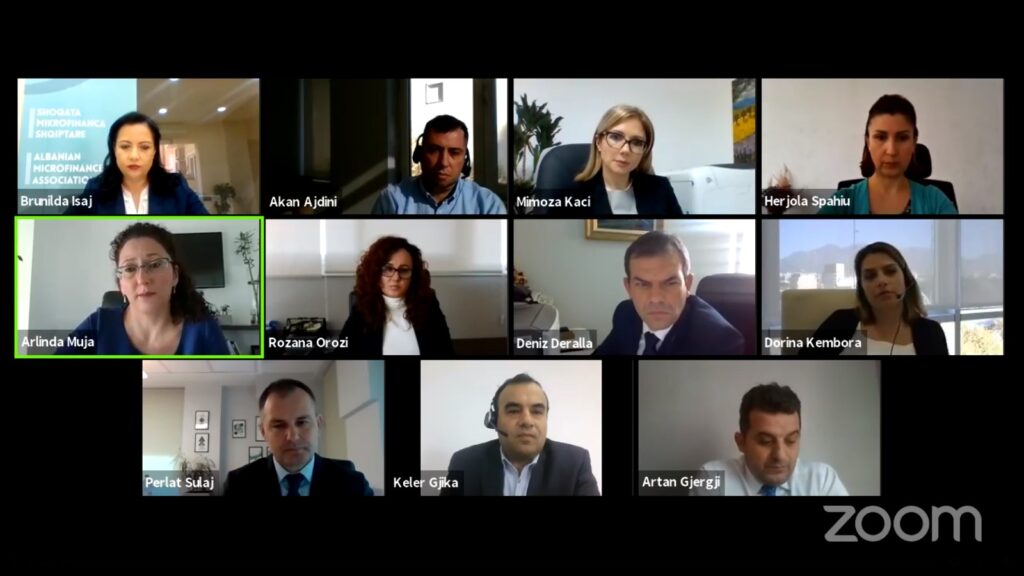

The Albanian Microfinance Association organized on November 25, 2020, an online event in the form of a video conference on the topic: “Albanian Microfinance in the New Normality: Weathering the Storm”. This Conference is organized on the occasion of the European Day of Microfinance and activities across the continent that are organized to promote microfinance and its role as a major supporter of the needy and enablers of social and financial inclusion.

In this event was discussed about the current issues of the sector, the challenges it has faced or is facing in the sustainable provision of services to customers, as well as opportunities and solutions that appear on the horizon to successfully overcome these challenges. Microfinance is the backbone of financial services provided to the needy, so every effort should be made to provide these segments with sustainable access to finance.

Speakers in the event were representatives from the Ministry of Finance and Economy, representatives from the Bank of Albania, the Financial Supervision Authority, the World Bank, the Albanian Banking Association, the Albanian Stock Exchange (ALSE), as well as international social finance promotion networks, such as the Center for Microfinance (MFC)

The event opened with the welcome speech of the current President of the Albanian Microfinance Association and Executive Director of Kredo Finance, Mrs. Arlinda Muja, who provided an overview of recent developments in the microfinance sector, also stressed the role of microfinance as a promoter of the local economy by providing access to finance for those segments of society that are not treated by the banking system or traditional finance. .

Deputy Minister of Finance and Economy, Mr. Besart Kadia, in his welcoming speech focused on the important role that microfinance plays in supporting small and medium-sized businesses and the marginalized strata, and that the Government has kept this segment in mind with the measures taken during the pandemic, but also following to provide relief and support in coping with the crisis. The government remains optimistic that the Albanian economy will soon return to the upward trend next year to stabilize in the future and appreciates the role of all financial actors in achieving this goal.

Further the event was greeted by Mr. Deniz Dëralla, Director of the Supervision Department at the Bank of Albania, who gave his assessments for non-bank financial institutions, providers of microfinance products, recognizing their role and importance in the overall financial system, thanks to financial inclusion and growth the level of financial education of the population they serve. He said that the Bank of Albania during this difficult period has provided support and flexibility for microfinance institutions, applying a series of measures which were considered necessary by the regulator to maintain the macroprudential parameters of the system, but also health and continuity of the activity of financial institutions.

Mrs. Mimoza Kaci, Deputy Executive Director of the Financial Supervision Authority, after appreciating the role of microfinance as a provider of primary access to finance for the needy, said that microfinance institutions are also considered catalysts of capital markets, as they can meet the needs for financing by offering financial instruments such as commercial bonds. The capital markets in Albania are developing rapidly, a development made possible by the recent legislative and regulatory changes undertaken by the Authority.

The greeting speeches were closed by Mr. Gzegorz Galusek, Executive Director of Microfinance Centre (MFC), a network of microfinance organizations promoting social finance, gender equality in entrepreneurship and responsible financing, based in Warsaw, Poland. He emphasized the role of microfinance across the continent in providing responsible products and services, such as green finance and hybrid products, new to the financial sector locally, in the global effort to assure climate protection, which are a crucial part of responsible financing.

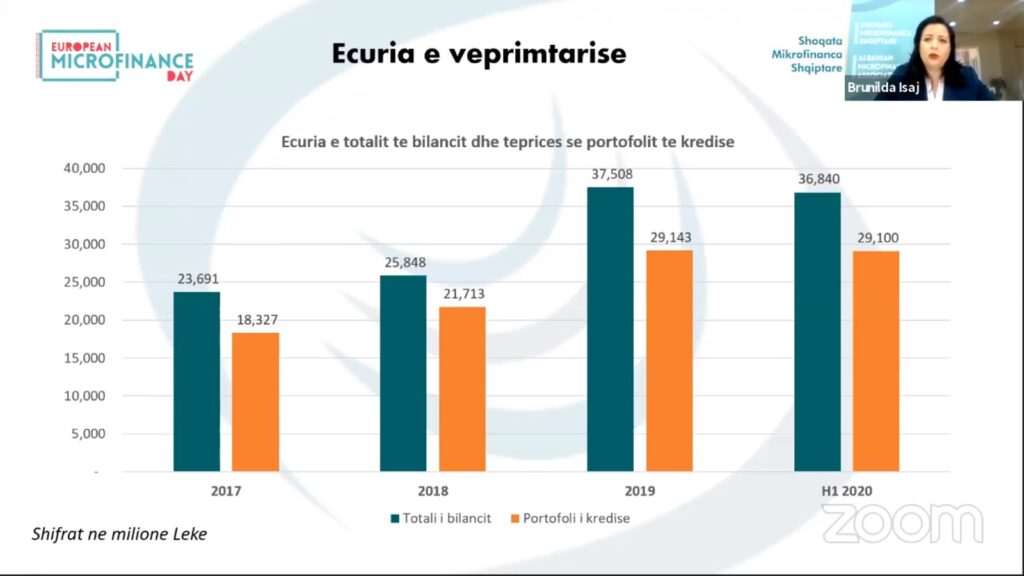

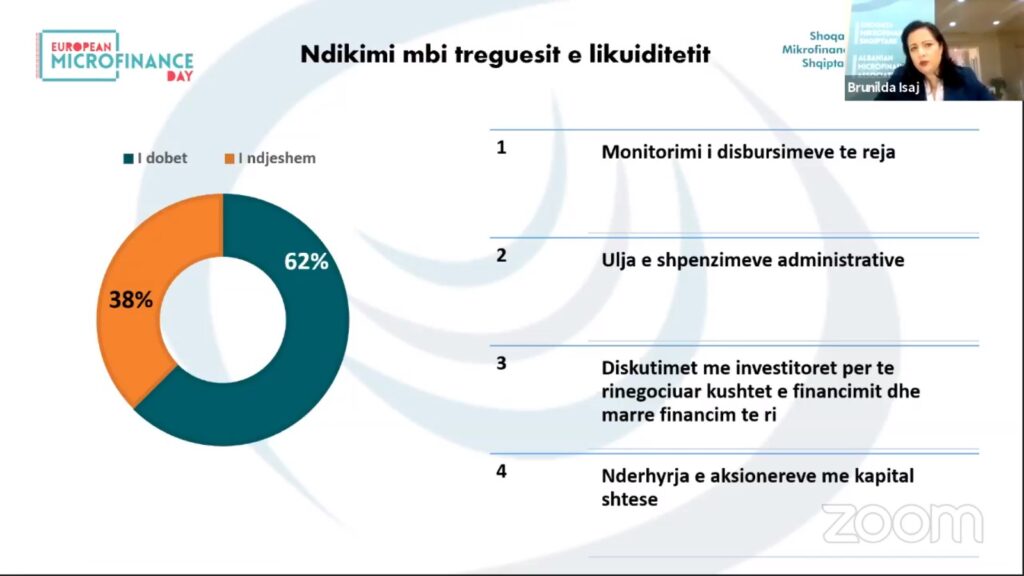

The conference proceedings continued in three sessions, where in the first one some of the microfinance challenges during 2020 and illustrative financial indicators were presented. Then, in the following two sessions, participants discussed finding sustainable funding sources for the microfinance sector, and the possibility of managing a potential crisis, in the face of a prolonged pandemic that could cause problems with loan portfolios.

At the end of the Conference, which was considered a very constructive event, the following conclusions were drawn:

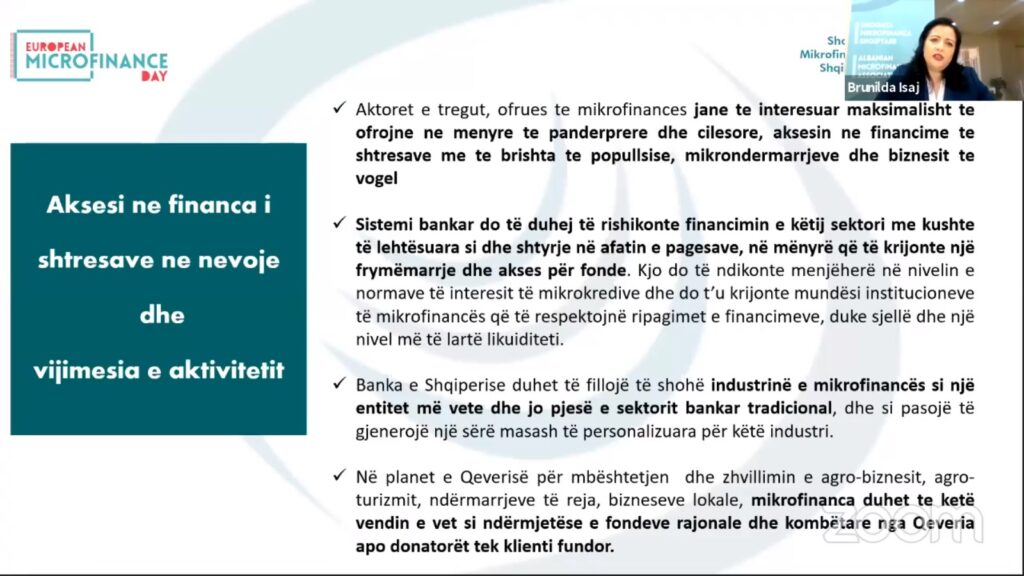

- The microfinance sector already seems to be in control of the situation, recognizing the consequences and having a clear plan for managing the crisis caused by the COVID-19 pandemic. The main goal of the sector is to continue to support and access business and household financing, further contributing to the country’s financial inclusion and economic recovery;

- The role of microfinance in the economy of each country remains clear, the sector aims to achieve the most significant degree of financing of the layers without easy access to financing from the banking system, and it is important to maintain this market segmentation, in order to enable the transition of market segments with difficult access to segments manageable by the banking sector;

- There are several alternatives for financing this sector, which have not yet been explored and which would add value if enabled by both government instruments and public offering, among which the synergies with capital markets and banking system are the most important, in order to strongly support the market that microfinance serves today.

- The support from the Bank of Albania and the World Bank, which have always been open to the sector’s proposals for overcoming this crisis, is confirmed.

- There is an increased interest from the Ministry of Finance and Economy for initiating discussion tables with the Microfinance sector in various directions, which will add value to the services that this industry offers, but also to the levels of access to finance, and in this context AMA will continue the constructive communications further.

The conference was attended with interest by a wide range of viewers, some of whom actively participated in the discussions. The sessions were also broadcasted live on social media.