Who We Are

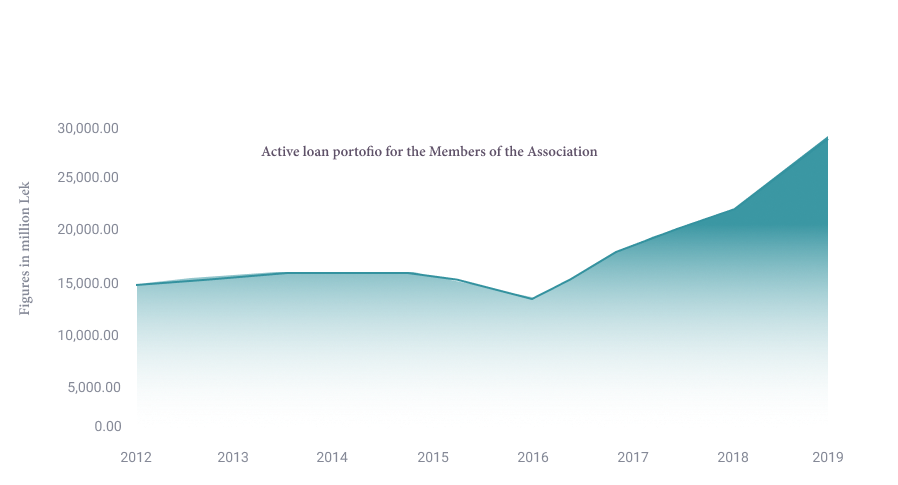

The Albanian Microfinance Association brings together the most consolidated Albanian microfinance institutions (MFIs) representing altogether an outstanding loan portfolio of ALL 39 billion and a number of more than 270,000 active clients.(year-end 2022 figures)

Albania continues to have a strong demand for micro-finance products. Most of Albanian MFIs follow a socially responsible policy targeting financially excluded individuals and disadvantaged areas. Microfinance sector supports a large scale of individuals, micro and small businesses and other market segments, with a strong focus on creating jobs, narrowing gender gaps in entrepreneurship and offering financial solutions in a sustainable manner.

AMA’s objectives are threefold.

• It represents when necessary, its members to national or international gatherings, legislative consultations and business events;

• It supports the technical and institutional consolidation of its members by exchanging best-practices and identifying financial and economic trends etc.

• It promotes financial education and financial literacy, access to finance, responsible and social financing, and the microfinance sector as whole.

Figures that speak alone thousands of supported, entrepreneurs, farmers and families.

Background

Albanian MFIs and AMA’s members are divided into two major groups. One the one hand, non-bank financial institutions such as NOA, Fondi Besa, Agro & Social Fund, IuteCredit Albania, Kredo Finance and Crimson Finance Fund Albania, and on the other hand, the Savings and Credit Associations which are financial cooperatives represented by their respective financial Unions such as FED Invest SHKK and UniFin SHKK.

AMA’s members have started their activity as early as 1992 at a time when Albania opened itself to a free market economy after having endured one of the most feared communist regimes for 45 years. The following development of microfinance in Albania was mainly due to the World Bank involvement as a key promoter of the financial inclusion of the poor by means of micro-loans. At the time, Albania’s economy hardly had any entrepreneurs, farmers and businesses as all economic activity was state-owned. In this context, microfinance was seen as the most effective manner to support a successful transition towards self-employment and private ownership.

Throughout the years, AMA’s members have undergone through various institutional changes, upgrades and strategic repositioning. They now represent a diversified set of actors, shareholders and clients, national and international, with a full coverage of the Albanian territory and of the financial market.

The microfinance sector has already entered a new phase of its development. It come in line with the socio-economic developments of the country, as well as the growing market demands not only for products and services that serve to raise living standards for individuals and enable free enterprise for micro-businesses, but also to ensure sustainability in quality of life and consolidation of local business activity, especially family business.

Throughout its existence, microfinance has been accompanied by its social mission — supporting the weakest without access to finance and without opportunities for financial development. In this context, all members have continued to work with customer awareness and increase the level of their financial education and have continuously increased the transparency with which financial services and products are provided.

-

1992

Rural Credit Pilot Project

-

1993

Creation of the Albanian Development Fund

-

1994

ADF creates two Departments for Rural and Urban Crediting

-

1998

Creation of Albanian Partnership for Microcredit (PSHM)

-

1999

• Creation of the Development Foundation-DF • Creation of the RFF, over the ADF’s Rural Credit Department • ADF’s urban Credit Department is transferred to BESA Fund

-

2001

Creation of Building Futures - BF

-

2002

Creation of ASC Union taking over the accumulated experience of ADF’s rural credit department

-

2004

DF is transformed to Jehona Union

-

2007

PSHM is transformed to Opportunity Albania

-

2008

MAFF is transformed to FAF d.c., while BESA Fund is licensed as an NBFI

-

2010

Opportunity Albania is transformed to NOA, BF is transformed to Vision Fund Albania

-

2015

ASC Union is transformed to FedInvest SHKK

-

2016

Vision Fund Albania is acquired by Fondi BESA and is transformed into Agro & Social Fund

-

2017

Kredo Finance entered the Albanian market and started lending in 2018

-

2022

Capital Invest is transformed into MiA Finance

-

1992

Rural Credit Pilot Project

-

1993

Creation of the Albanian Development Fund

-

1994

ADF creates two Departments for Rural and Urban Crediting

-

1998

Creation of Albanian Partnership for Microcredit (PSHM)

-

1999

• Creation of the Development Foundation-DF • Creation of the RFF, over the ADF’s Rural Credit Department • ADF’s urban Credit Department is transferred to BESA Fund

-

2001

Creation of Building Futures - BF

-

2002

Creation of ASC Union taking over the accumulated experience of ADF’s rural credit department

-

2004

DF is transformed to Jehona Union

-

2007

PSHM is transformed to Opportunity Albania

-

2008

MAFF is transformed to FAF d.c., while BESA Fund is licensed as an NBFI

-

2010

Opportunity Albania is transformed to NOA, BF is transformed to Vision Fund Albania

-

2015

ASC Union is transformed to FedInvest SHKK

-

2016

Vision Fund Albania is acquired by Fondi BESA and is transformed into Agro & Social Fund

-

2017

Kredo Finance entered the Albanian market and started lending in 2018

-

2022

Capital Invest is transformed into MiA Finance

Mission and Vision

The Albanian Microfinance Association (AMA) operates in this specific economic context with the ultimate objective to serve the future economic development of the country, and in particular to boost job creation and the financial inclusion of self-employed individuals, farmers, small entrepreneurs and SMEs through the strengthening of the micro-finance sector and the MFIs operating in it. AMA’s action is part of a collective and joint effort among its member MFIs, to increase the institutional visibility on the impact micro-finance has on the national economy. AMA has similarly a key role into improving the legal and supervisory framework regulating the micro-finance activity in Albania by promoting best practices, sharing knowledge and spreading new instruments among its members and the general public.

Governance

Member’s Assembly

The highest decision-making body of the Association is the General Meeting of Members. In accordance with the procedures set out in the law or in this statute, the General Meeting of Members is convened once a year, as well as within the time set for their development. The General Meeting of Members consists of the Executive Directors, representing the Member Institutions of the Association

The President

The Association has its executive body the President of the Association. The President is elected by the Members’ Assembly on a biannual basis according to a pre-agreed rotating system. The President of Albanian Microfinance Association for year 2020 is Ms. Arlinda Muja, Executive Director of Kredo Finance shpk.

The General Secretary

The main functions of representation and administration for the Association are performed by the General Secretary, who is responsible for cooperating and liaising with regulators and public institutions on behalf of the Association, media relations, handling and properly managing day to day financial activity of the Association, etc. The General Secretary of AMA is appointed Ms. Junida Tafaj.

Membership to various networks

Contact

ALBANIAN MICROFINANCE ASSOCIATION

Address: St. ”Ibrahim Rugova”, Floor 3,No. 13, Tirana

Phone: +355 69 40 92 229

E-mail: info@ama.com.al